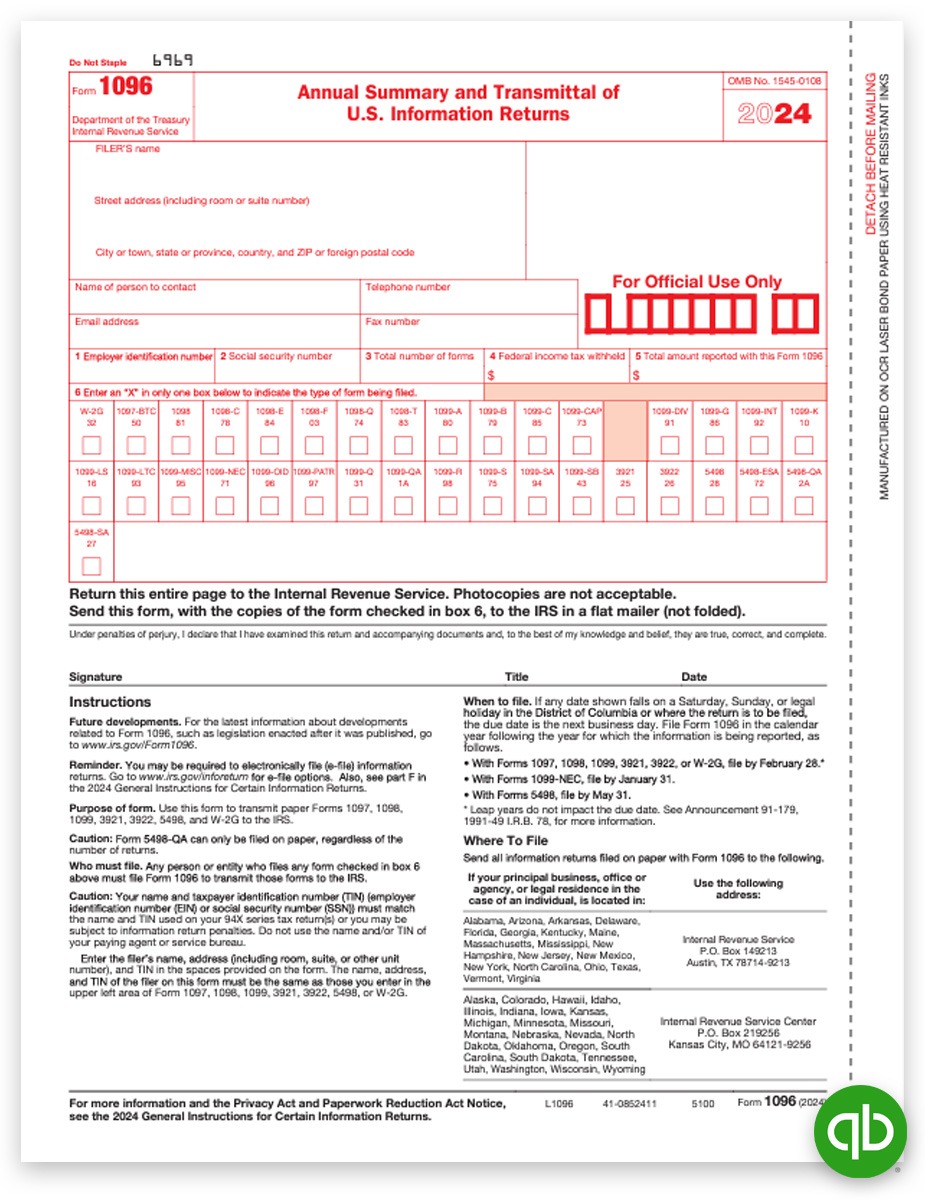

Free Printable 1099 Tax Form IRS Tax Tip 2025 05 Jan 14 2025 Business taxpayers can file electronically any Form 1099 series information returns for free with the IRS Information Returns Intake System The IRIS Taxpayer Portal is available to any business of any size It s secure reduces the need for paper forms and requires no special software

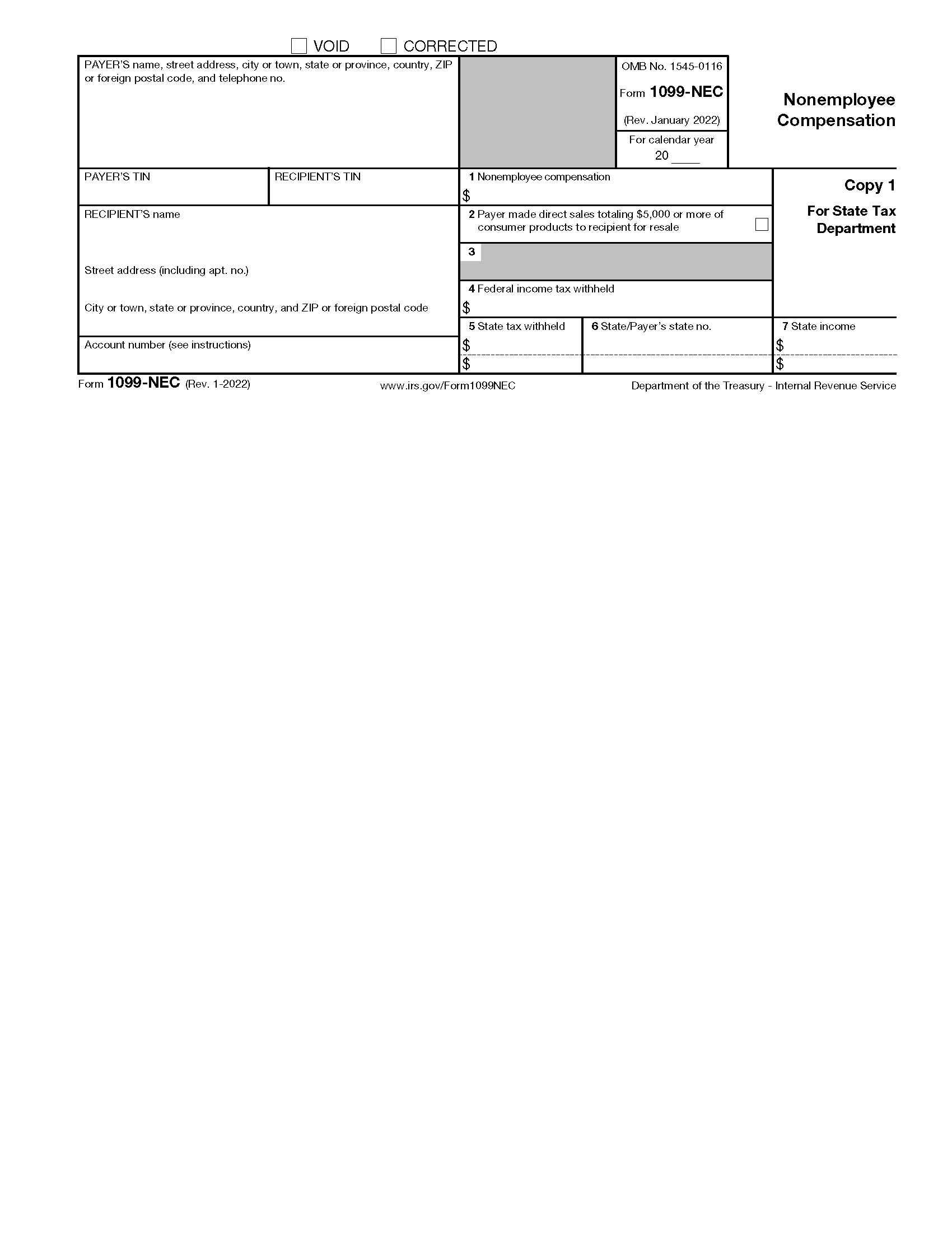

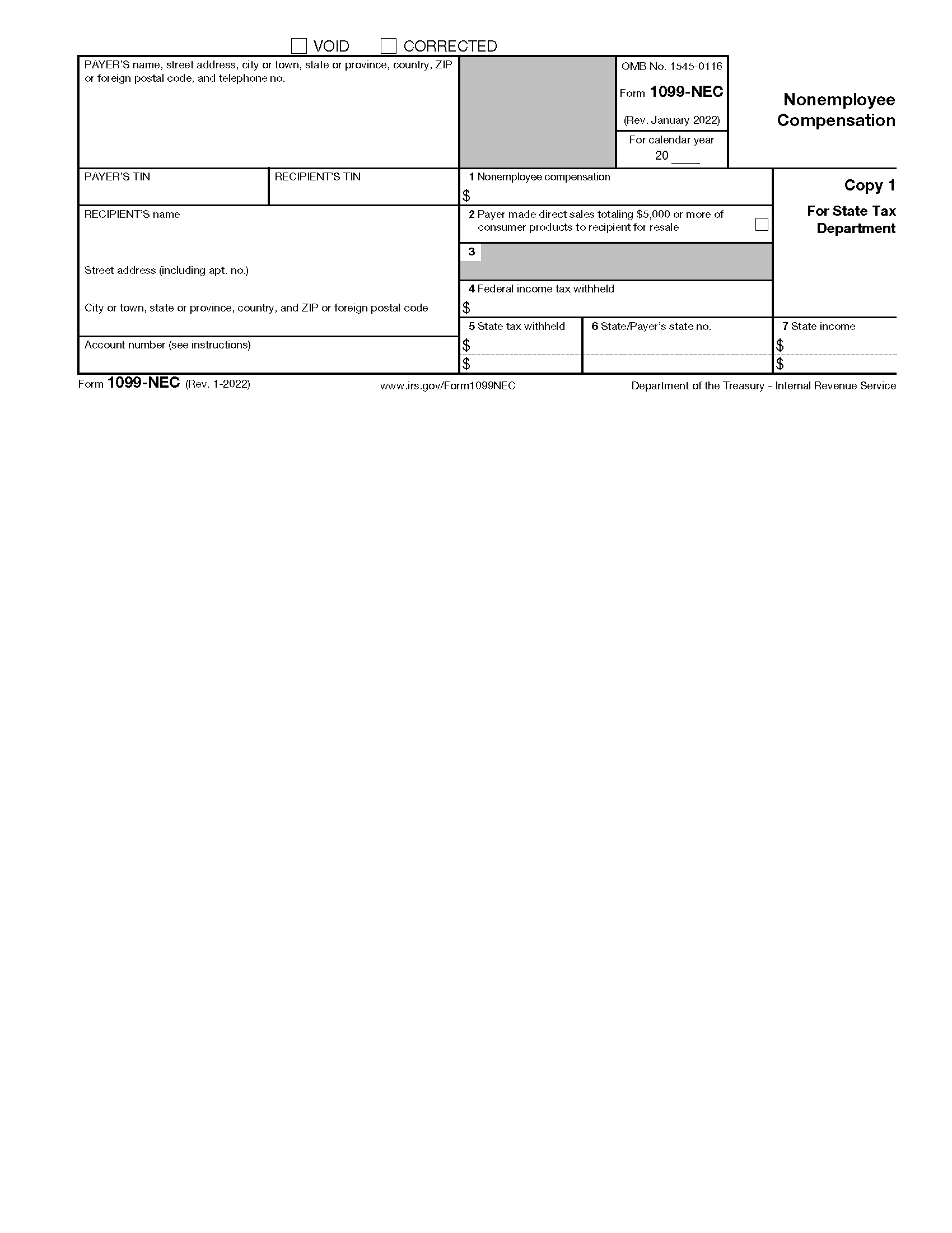

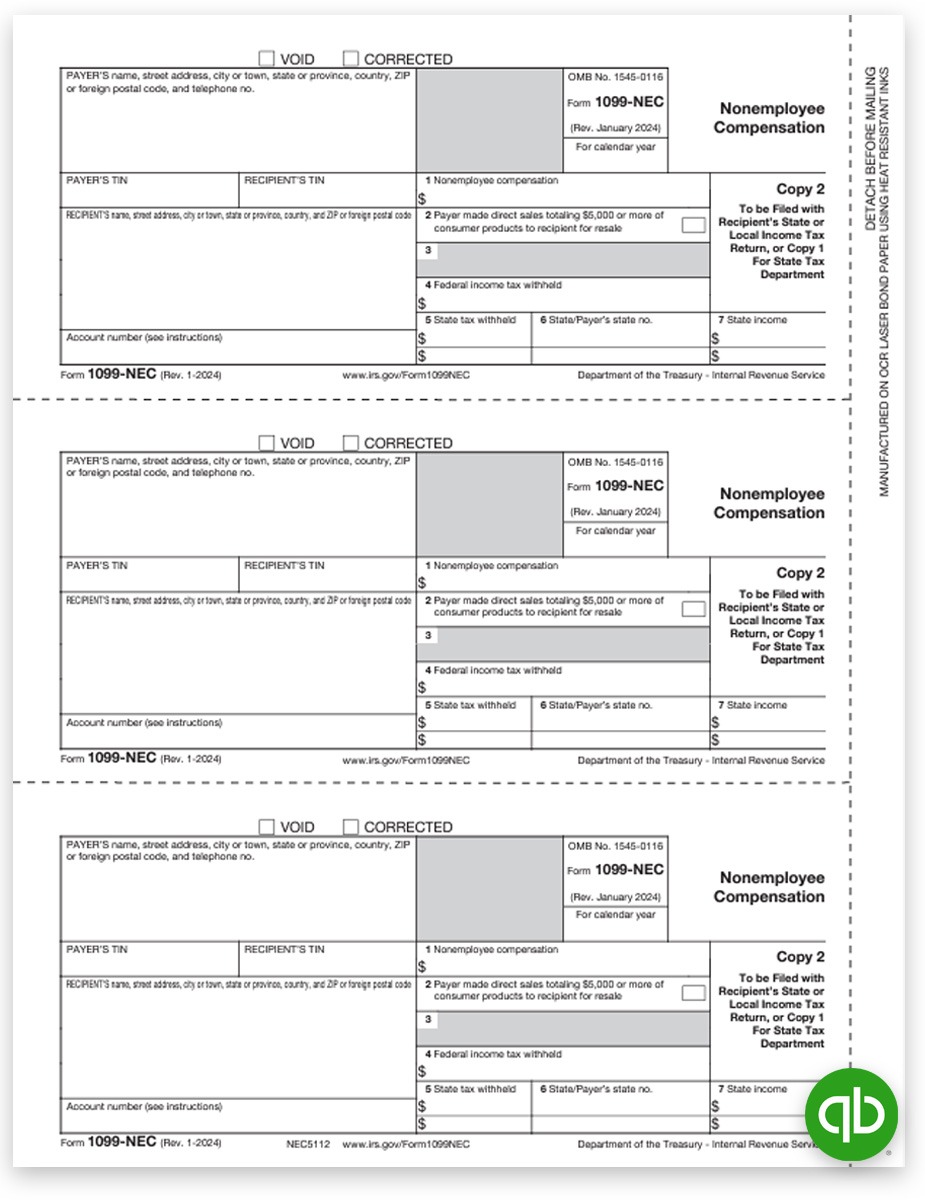

Print and file copy A downloaded from this website a penalty may be imposed for filing with the IRS Form 1099 NEC Rev January 2024 Cat No 72590N Nonemployee Compensation Copy A For Internal Revenue and Medicare taxes are withheld you should make estimated tax payments See Form 1040 ES or Form 1040 ES NR Individuals must IRS 1099 Forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages such as freelance earnings interest dividends and more There are 20 active types of 1099 forms used for various income types

Free Printable 1099 Tax Form

Free Printable 1099 Tax Form

Free IRS 1099 Form - PDF – eForms

2024 IRS Form 1099-NEC | Fill Out & Save With Our PDF Editor

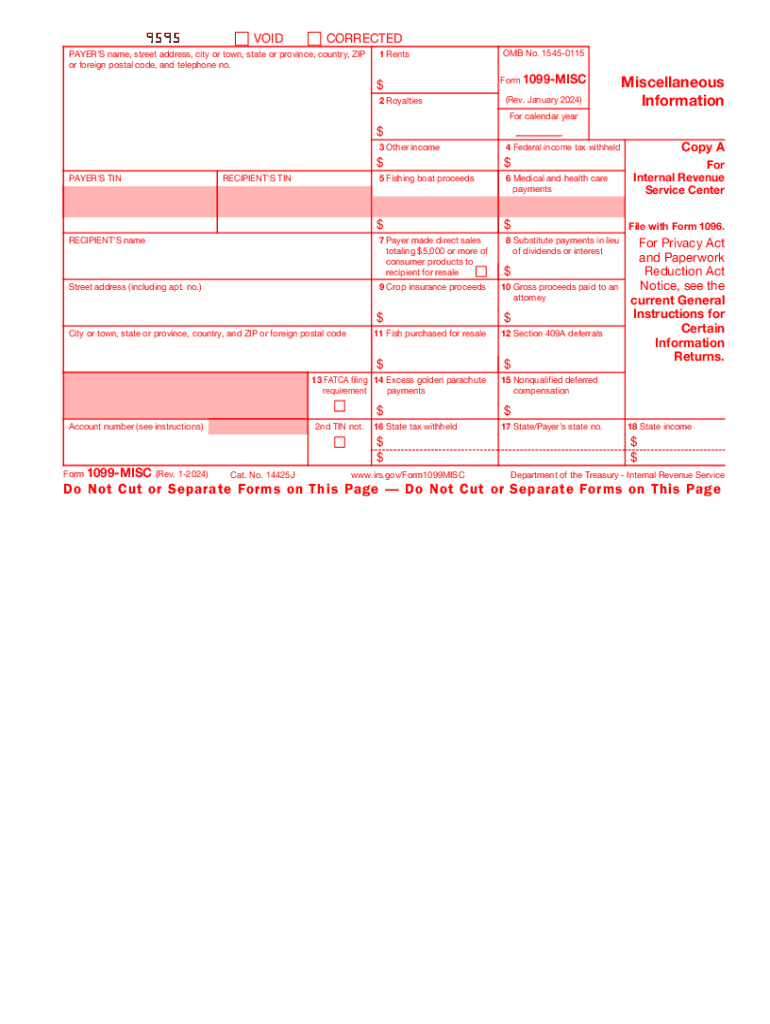

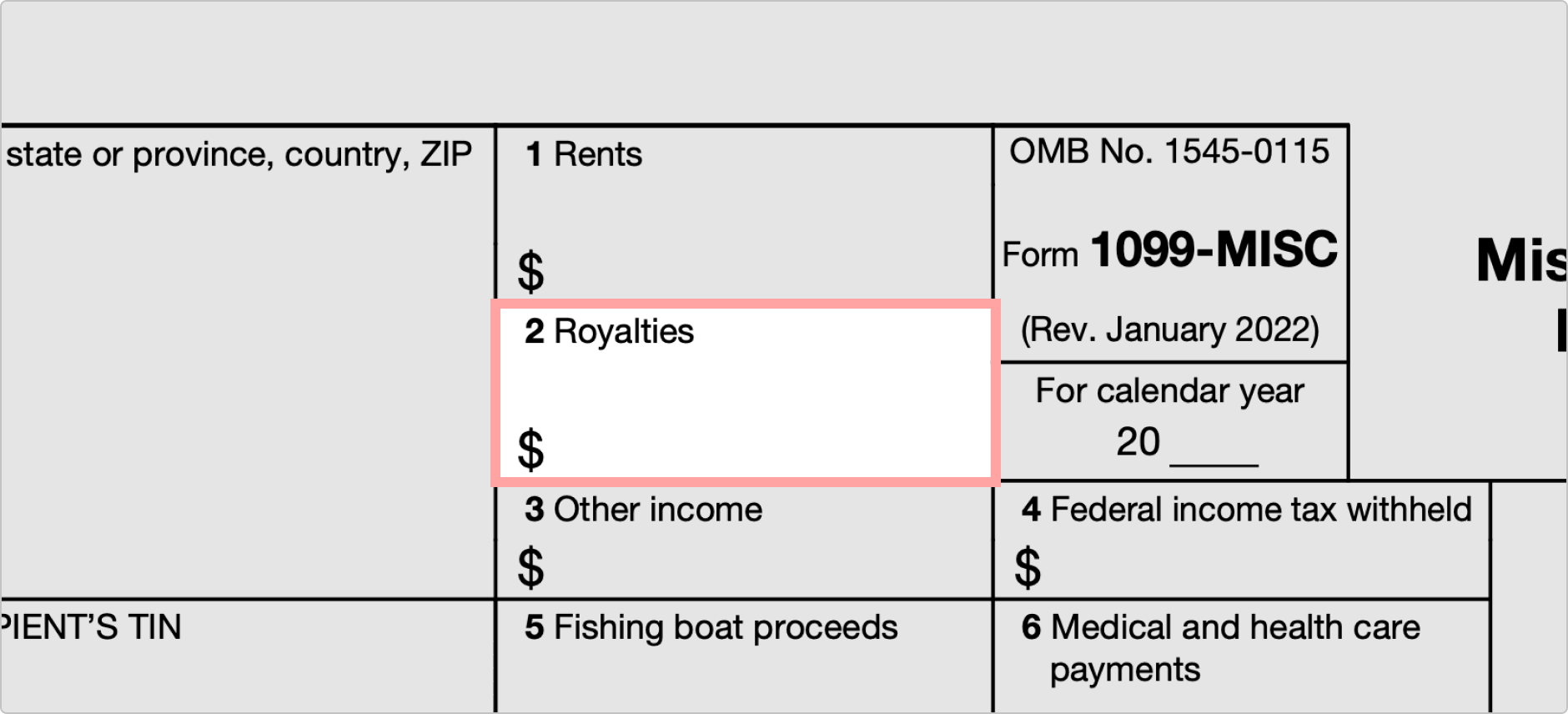

A 1099 MISC is a tax form used to report certain payments made by a business or organization Payments above a certain dollar threshold for rent royalties prizes awards medical and legal exchanges and other specific transactions must be reported to the IRS using this form Employee and non employee compensation are reported separately A 1099 NEC form non employee compensation is an IRS tax document that reports payments made by businesses or individuals to independent contractors or non employees The paying party must issue a 1099 NEC if payments during a calendar year exceed 600 and the recipient must use the form to report their income when filing taxes

Here are some hot tax topics to review before rushing to file your 2024 federal income tax return What to do with that Form 1099 K to print anything out The Free Fillable forms are all Unlike many other tax forms the IRS hasn t made any significant updates to the 2024 Form 1099 MISC Miscellaneous Income Since 2022 it has been a continuous use form meaning the fields details and instructions remain consistent from year to year you can ensure the process is smooth and error free Use Form W 9 to collect the TINs

More picture related to Free Printable 1099 Tax Form

2024 IRS Form 1099-MISC | Fill Out & Save With Our PDF Editor

1099 Form 2024 PDF (NEC or MISC) With Simple Instructions | OnPay

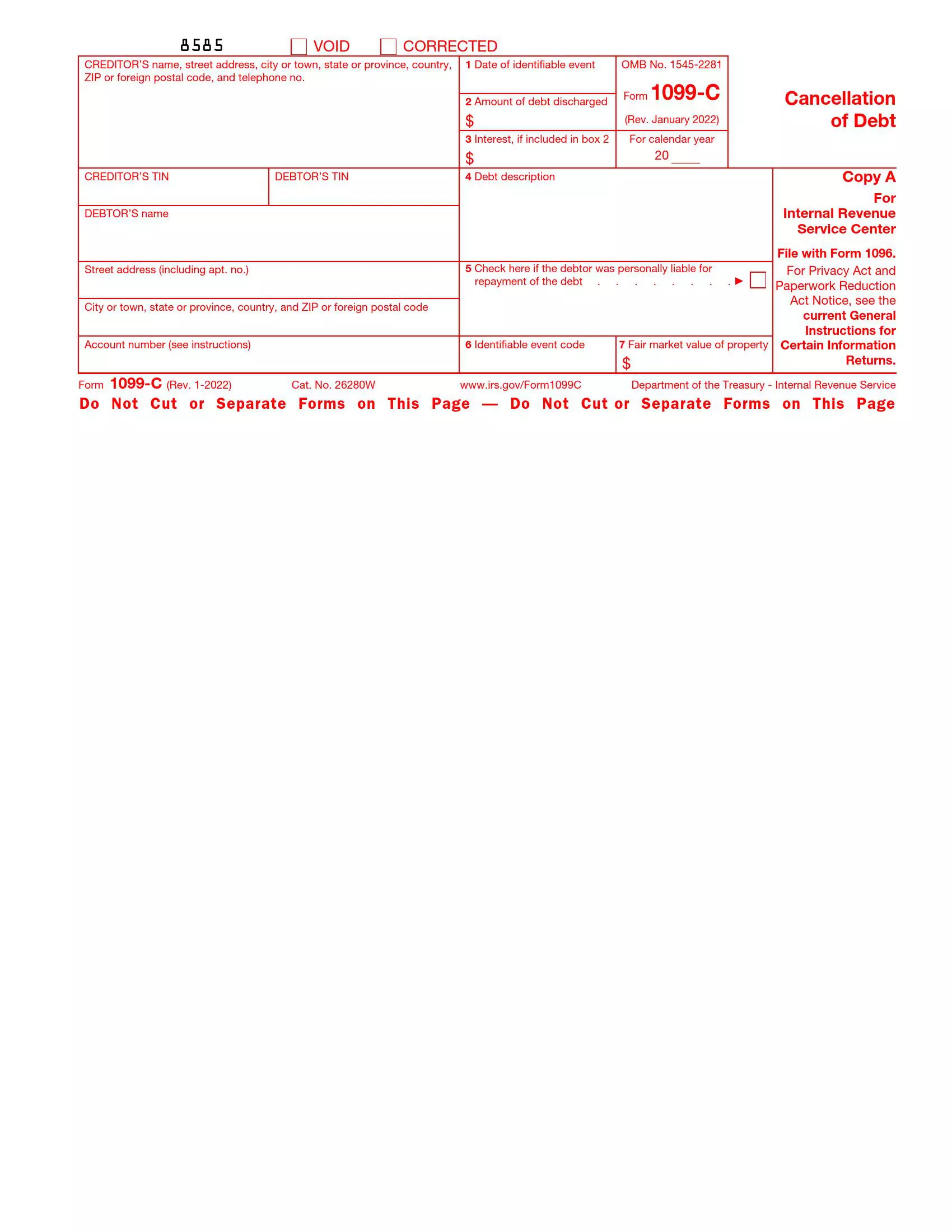

IRS Form 1099-C ≡ Fill Out Printable PDF Forms Online

Opinions expressed by Forbes Contributors are their own Robert W Wood is a tax lawyer focusing on taxes and litigation Closeup of Form 1099 NEC and 1099 MISC The IRS has reintroduced Form 1099 Starting with the tax year of 2020 a 1099 MISC Form is meant to be filed for every person i e non employee you have paid over 600 for an assorted list of miscellaneous business payments Those who need to send out a 1099 MISC can acquire a free fillable form by navigating the website of the IRS Download and Print a 1099 MISC Form

[desc-10] [desc-11]

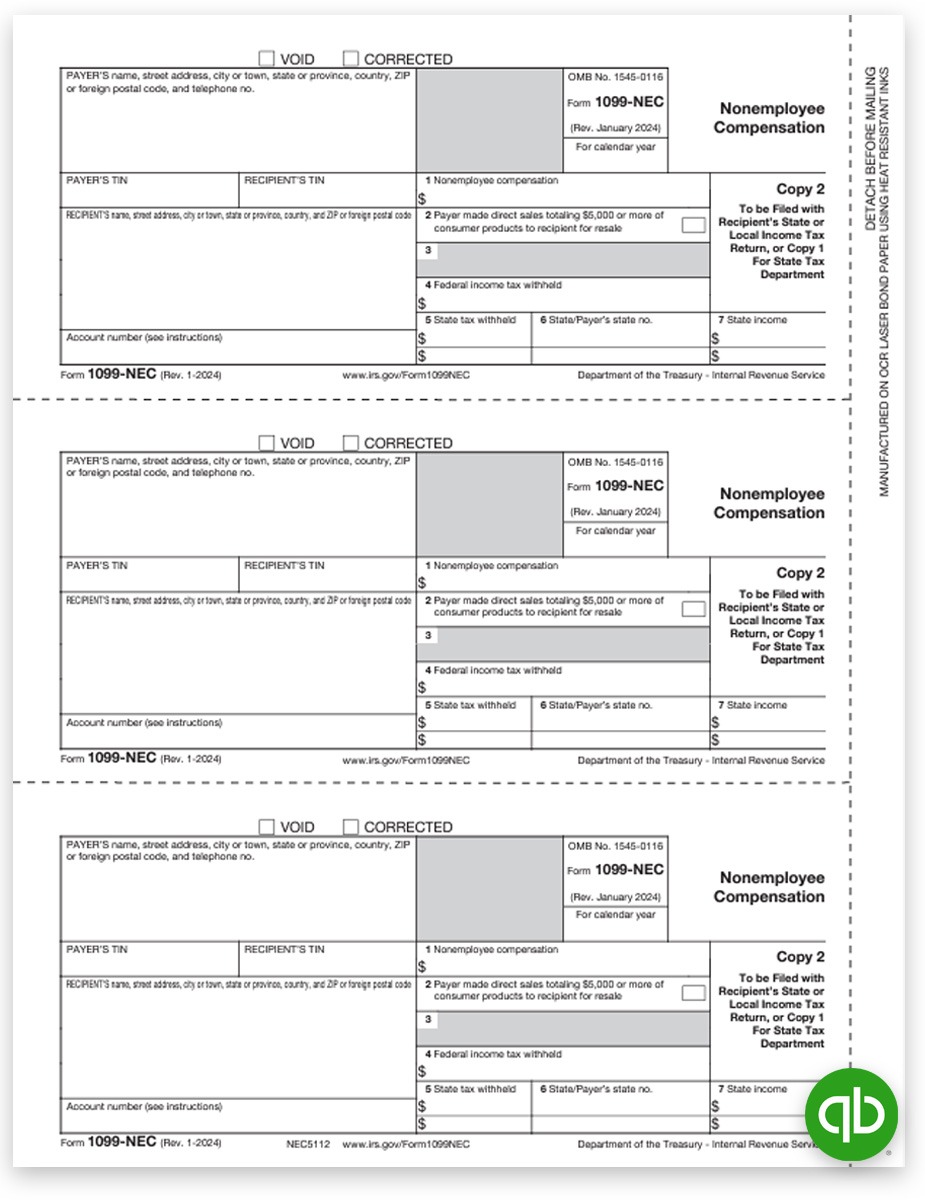

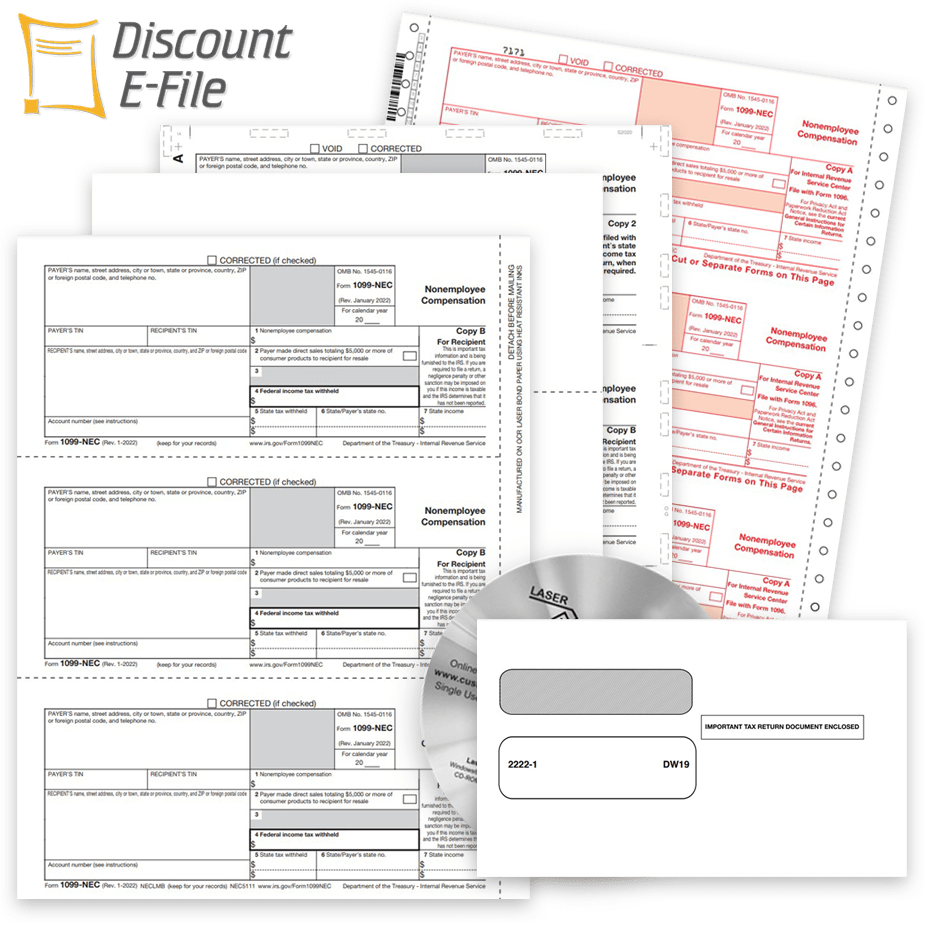

Intuit QuickBooks 1099-NEC Tax Forms Set - DiscountTaxForms

2024 1099-MISC Form: Fillable, Printable, Download. 2024 Instructions

https://www.irs.gov/newsroom/file-form-1099-series-information-returns-for-free-online

IRS Tax Tip 2025 05 Jan 14 2025 Business taxpayers can file electronically any Form 1099 series information returns for free with the IRS Information Returns Intake System The IRIS Taxpayer Portal is available to any business of any size It s secure reduces the need for paper forms and requires no special software

https://www.irs.gov/pub/irs-pdf/f1099nec.pdf

Print and file copy A downloaded from this website a penalty may be imposed for filing with the IRS Form 1099 NEC Rev January 2024 Cat No 72590N Nonemployee Compensation Copy A For Internal Revenue and Medicare taxes are withheld you should make estimated tax payments See Form 1040 ES or Form 1040 ES NR Individuals must

Intuit QuickBooks 1099-NEC Tax Forms Set - DiscountTaxForms

Intuit QuickBooks 1099-NEC Tax Forms Set - DiscountTaxForms

.png)

Can You Print 1099 Forms From a Regular Printer? Everything You Need to Know

What Is a 1099 Form—and How Does It Affect Your Expat Taxes?

W-2 and 1099 Template

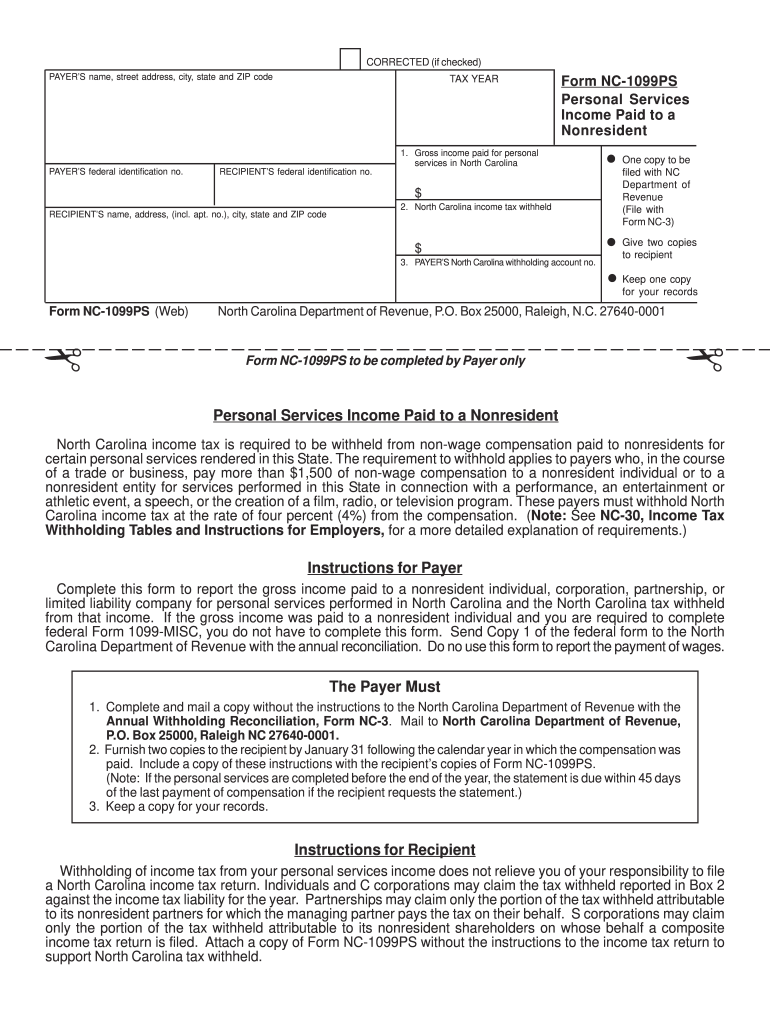

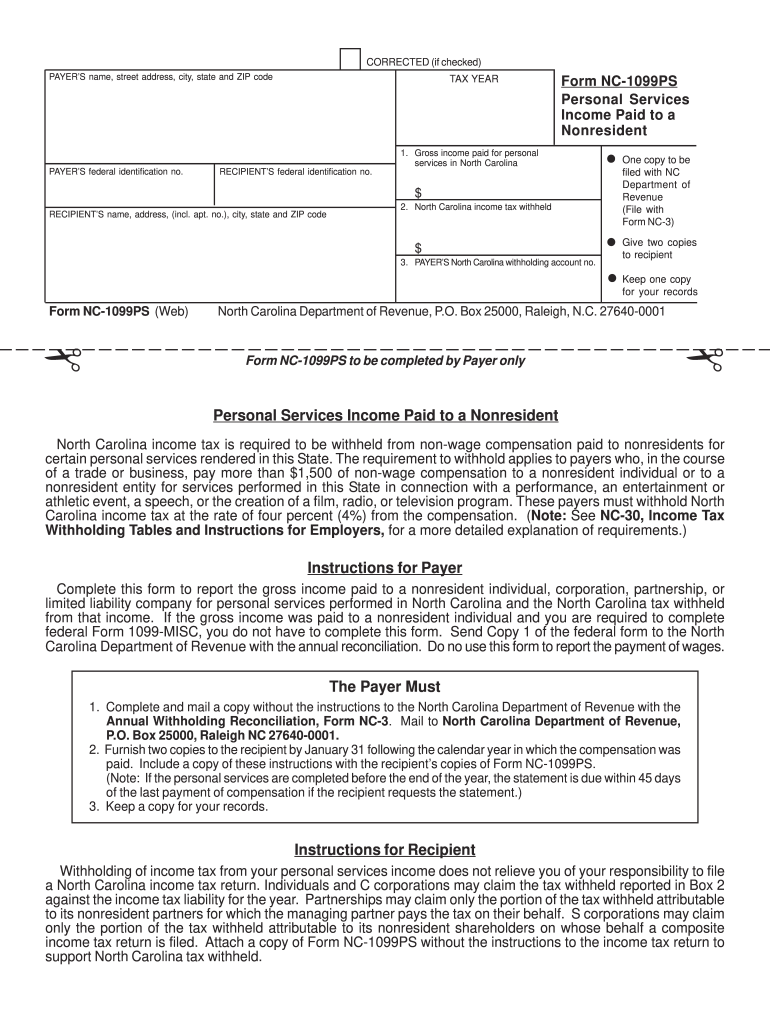

Nc 1099 form printable: Fill out & sign online | DocHub

Nc 1099 form printable: Fill out & sign online | DocHub

1099NEC Tax Forms for Non-Employee Compensation - DiscountTaxForms

Form 1099-SA | Form Pros

:max_bytes(150000):strip_icc()/form-1099-int.asp-final-2599de13e6834f20ae53280607b01e17.jpg)

Form 1099-INT: What It Is, Who Files It, and Who Receives It

Free Printable 1099 Tax Form - [desc-12]