Free Printable 1099 Template Enter information into the portal or upload a file with a downloadable template in IRIS Download completed copies of Form 1099 series information returns Submit extensions Make corrections to information returns filed with IRIS Get alerts for input errors and missing information

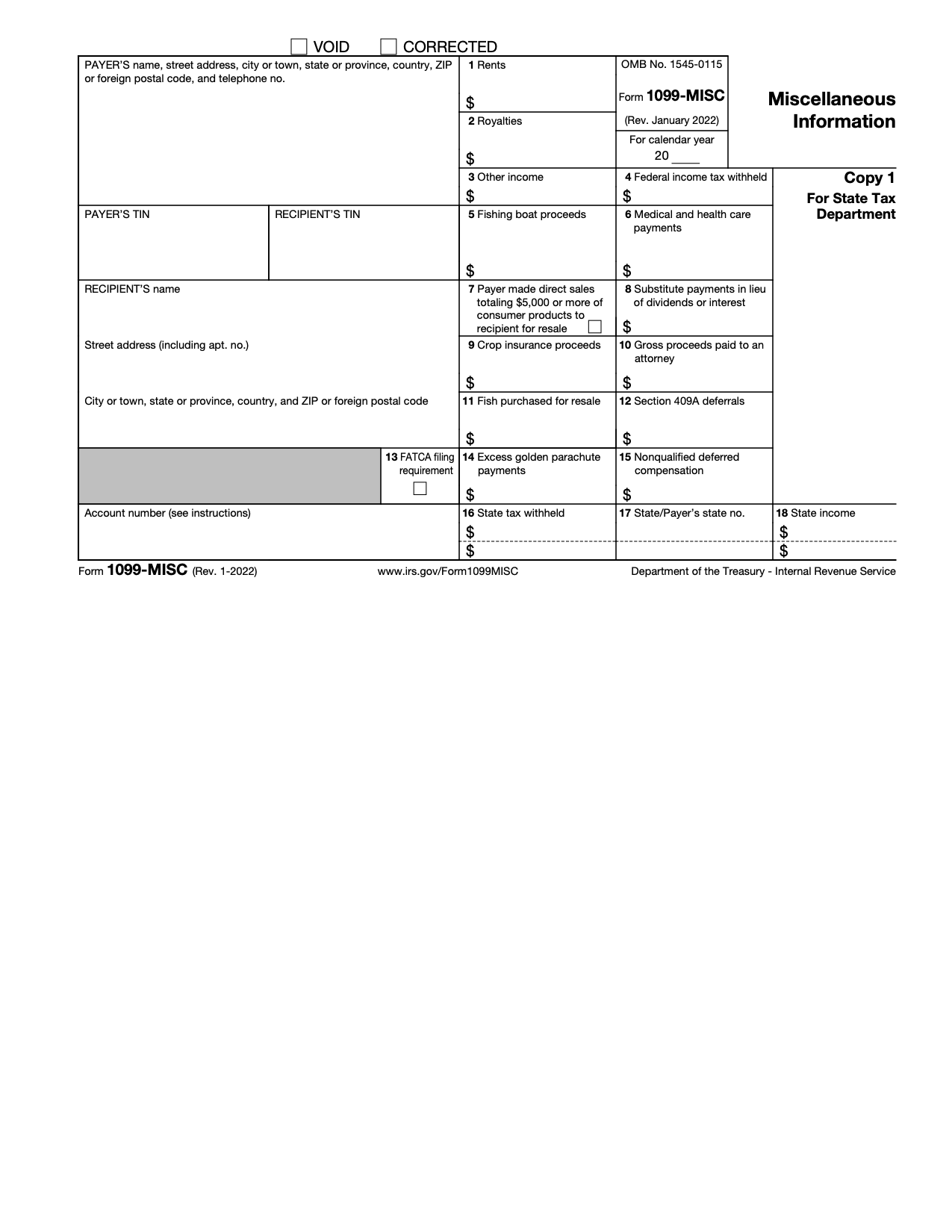

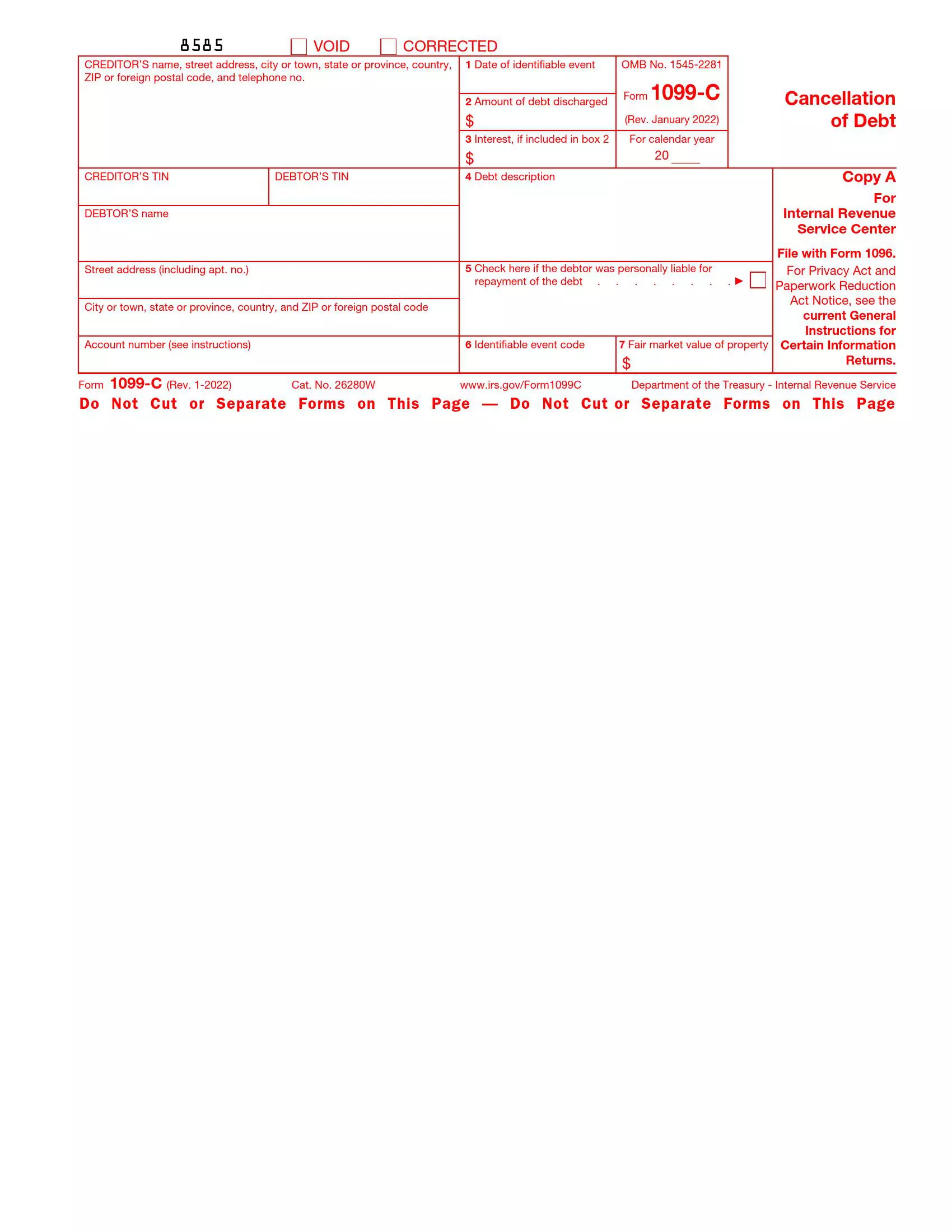

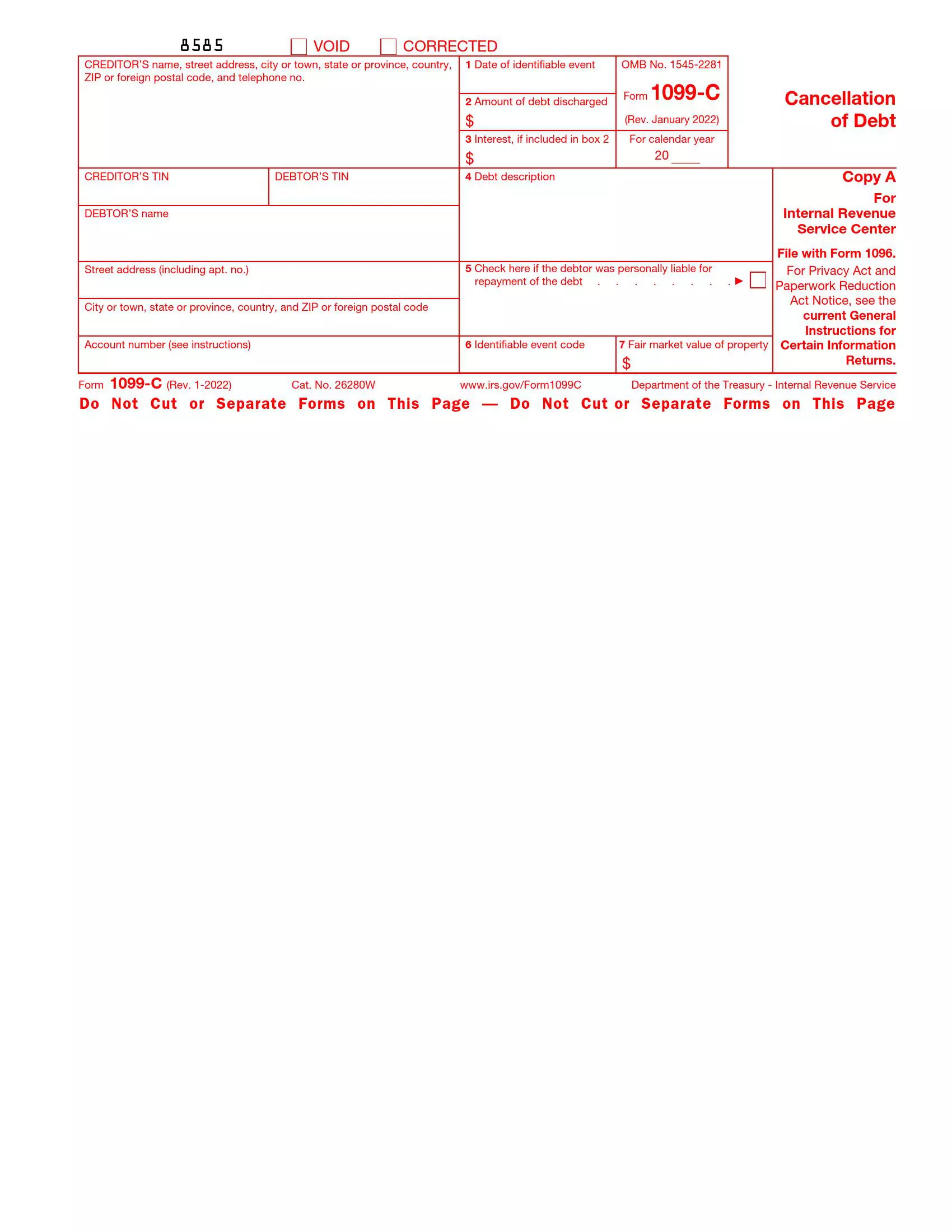

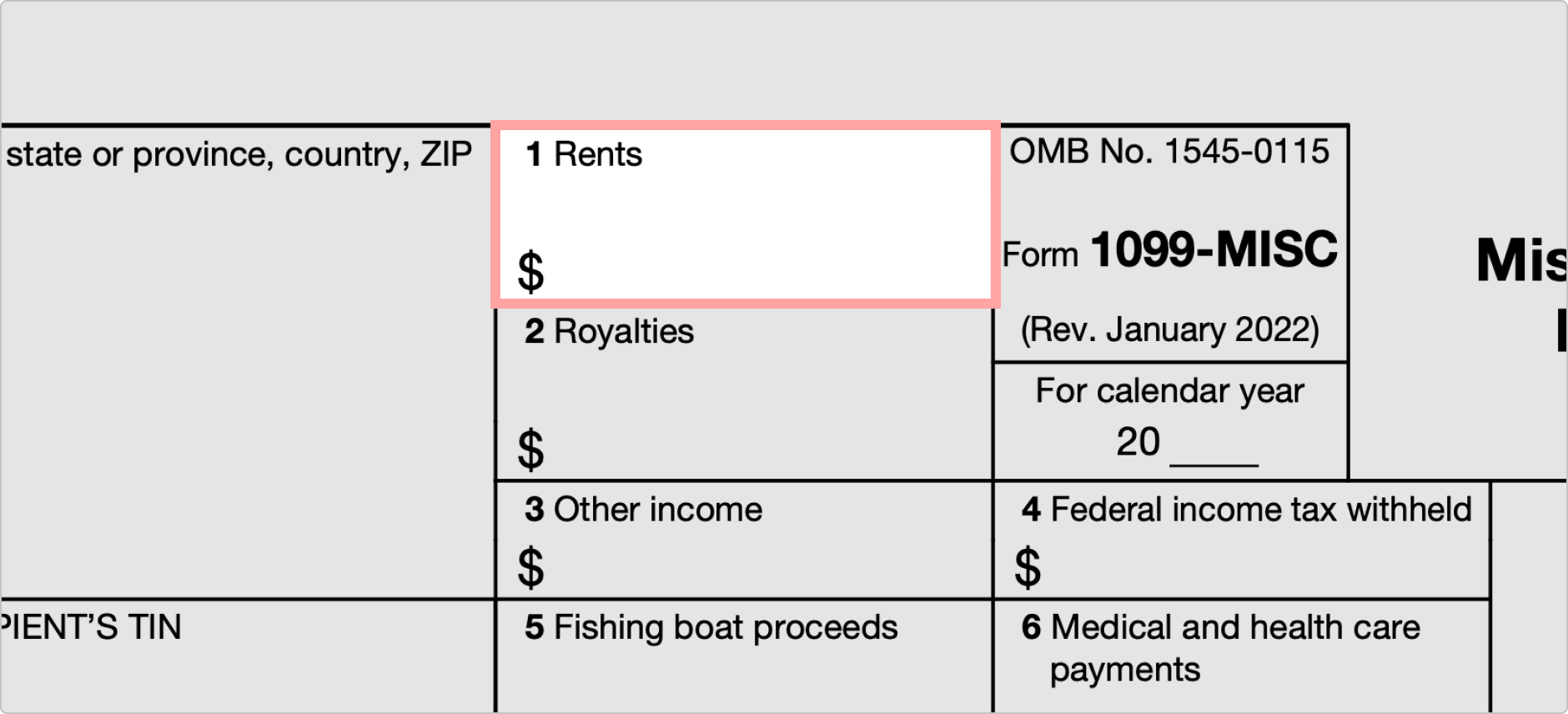

A 1099 MISC is a tax form used to report certain payments made by a business or organization Payments above a certain dollar threshold for rent royalties prizes awards medical and legal exchanges and other specific transactions must be reported to the IRS using this form Employee and non employee compensation are reported separately Access the IRS s full list of miscellaneous income 1099 MISC Exempt from 1099 Corporations Beholden to their own tax reporting requirements and file their own tax returns without the need for a 1099 you may file a black and white Copy A that you print from the IRS website with Form 1096 7 How to File 5 Steps

Free Printable 1099 Template

Free Printable 1099 Template

Free IRS 1099 Form - PDF – eForms

2024 IRS Form 1099-MISC | Fill Out & Save With Our PDF Editor

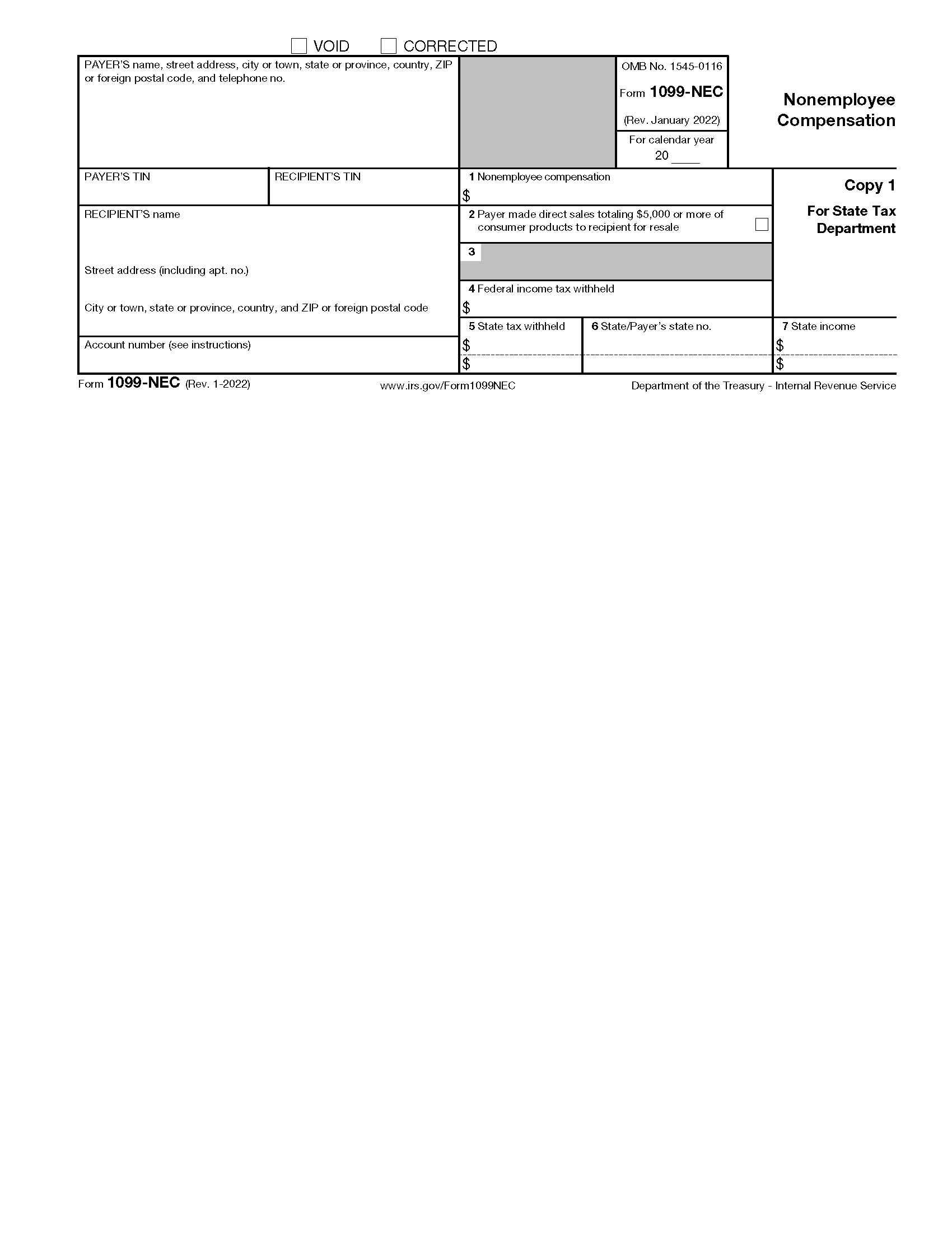

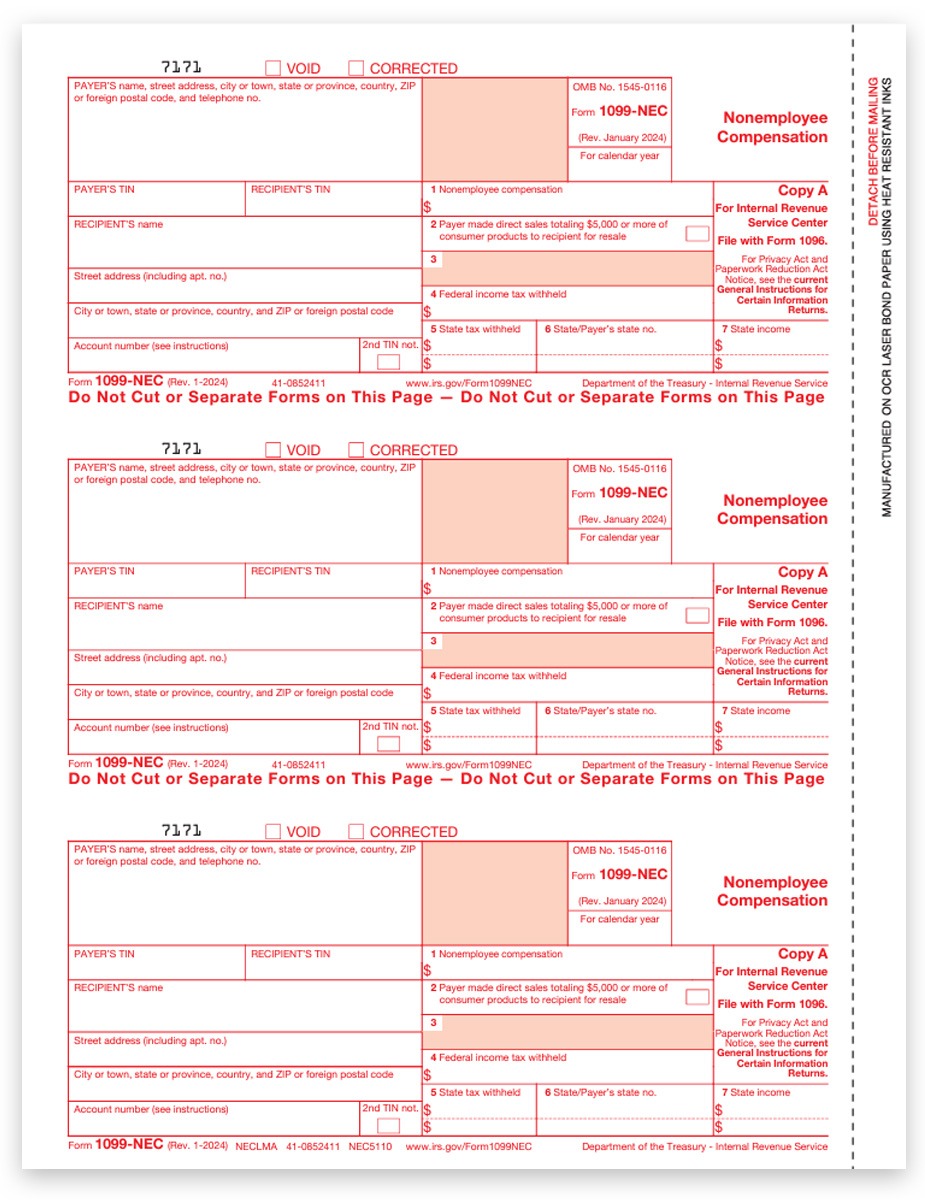

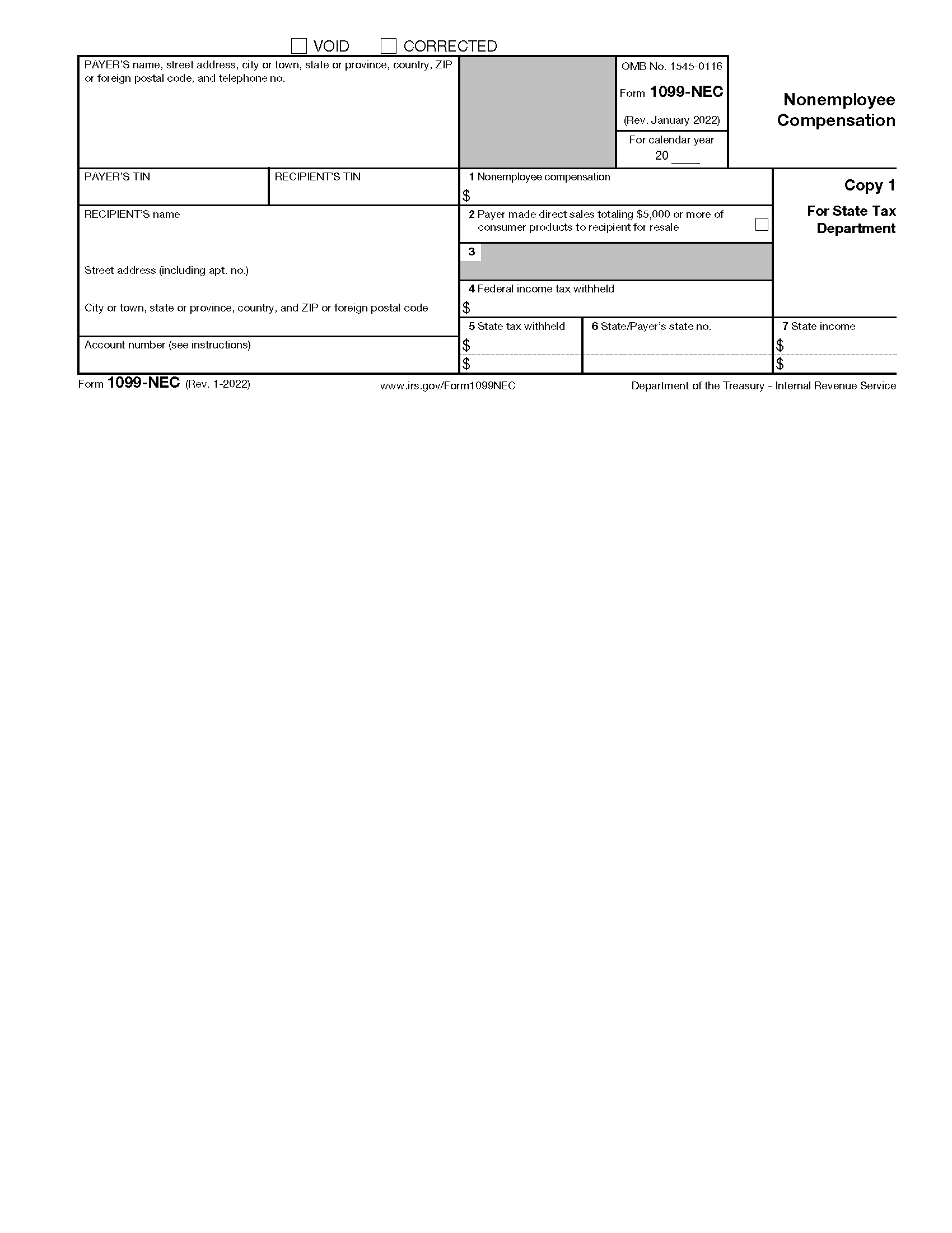

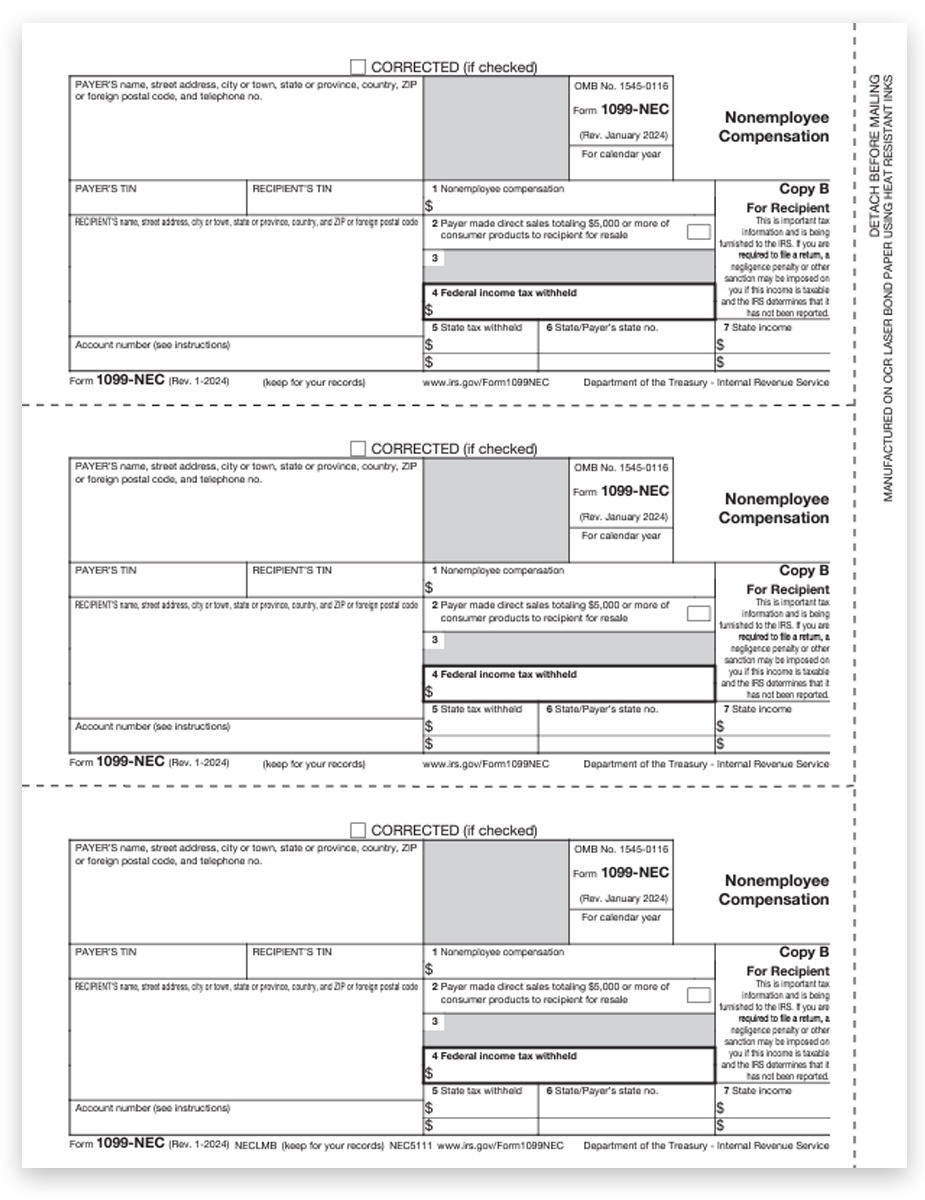

A 1099 NEC form non employee compensation is an IRS tax document that reports payments made by businesses or individuals to independent contractors or non employees The paying party must issue a 1099 NEC if payments during a calendar year exceed 600 and the recipient must use the form to report their income when filing taxes Form 1099 NEC Reports nonemployee compensation Form 1096 Summarizes all information returns a business submits to the IRS Form W 9 Lets a business collect taxpayer identification information from payees Form 1099 K Reports payments made to a business via a credit card processor or another third party network Legal Considerations

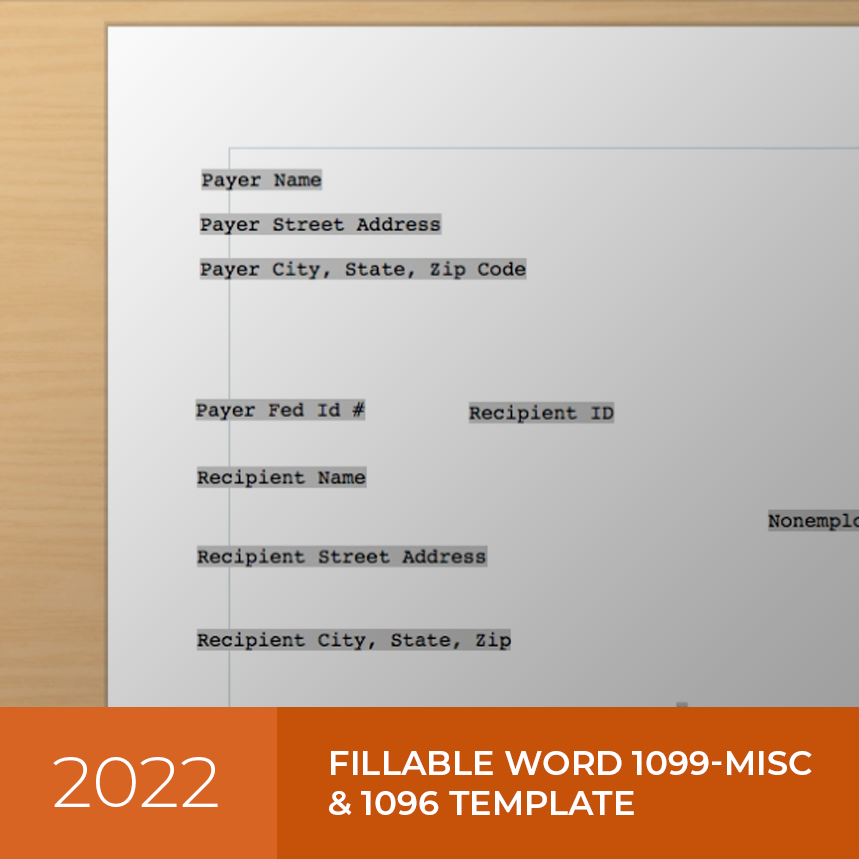

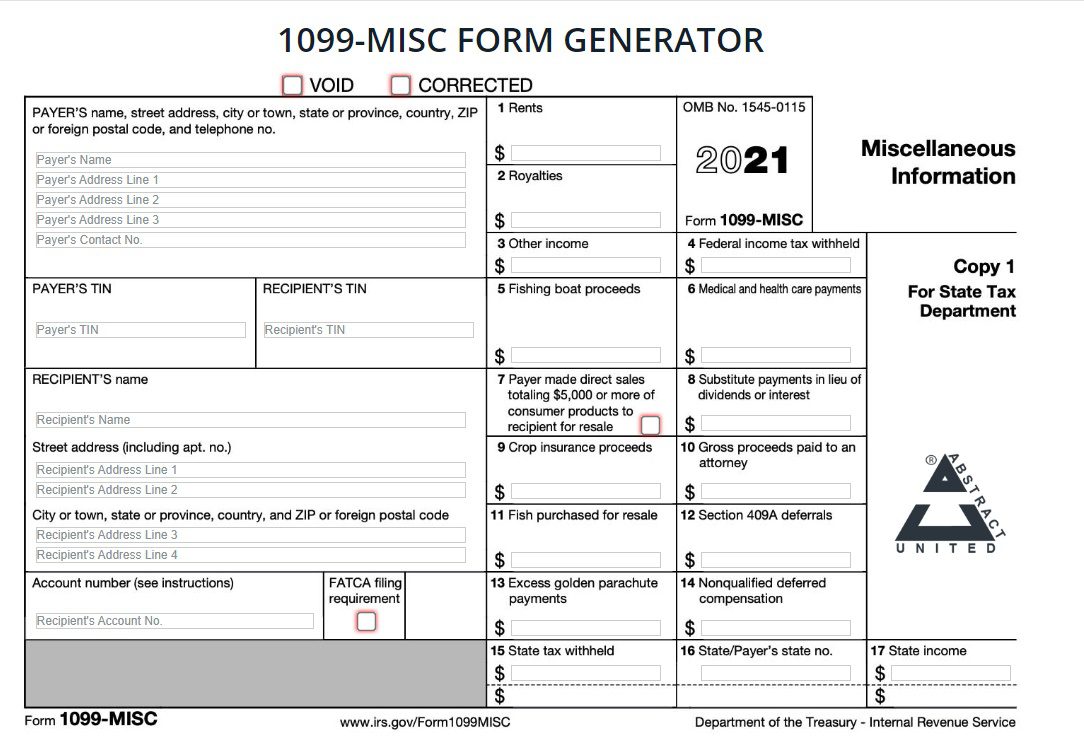

It s free to use but you ll need to apply for an IRIS Transmitter Control Code TCC Some third party providers also facilitate Form 1099 NEC filings through their software The deadline for filing Form 1099 NEC with the IRS is January 31 2025 for the 2024 tax year You must also provide a copy to your recipient payees by this date An IRS Form 1099 MISC is used to report payments other than employee compensation made by a business across a tax year Use this free 1099 MISC template to take the hassle out of the filing process Simply hit download fill in your details and send it in to the IRS

More picture related to Free Printable 1099 Template

2024 IRS Form 1099-NEC | Fill Out & Save With Our PDF Editor

2021 1099-NEC Word Template — 1099misctemplate.com

1099 Form 2024 PDF (NEC or MISC) With Simple Instructions | OnPay

Download fillable Excel template spreadsheet to easily print onto IRS 1099 form with proper alignment 1099 NEC 1099 MISC 1099 INT 1096 No sign up Easily Align and Print Your 1099 Forms Using Our Excel Customized Templates Download Word Template Download PDF Create Custom 1099 MISC Form 1099 MISC Document Information Those who need to send out a 1099 MISC can acquire a free fillable form by navigating the website of the IRS Download and Print a 1099 MISC Form 2024 For filling out taxes on income earned from 1 1 2024 to 12 31 2024

[desc-10] [desc-11]

IRS Form 1099-C ≡ Fill Out Printable PDF Forms Online

1099-NEC Forms, Copy A for IRS Federal- DiscountTaxForms.com

https://www.irs.gov/newsroom/file-form-1099-series-information-returns-for-free-online

Enter information into the portal or upload a file with a downloadable template in IRIS Download completed copies of Form 1099 series information returns Submit extensions Make corrections to information returns filed with IRIS Get alerts for input errors and missing information

https://eforms.com/irs/form-1099/misc/

A 1099 MISC is a tax form used to report certain payments made by a business or organization Payments above a certain dollar threshold for rent royalties prizes awards medical and legal exchanges and other specific transactions must be reported to the IRS using this form Employee and non employee compensation are reported separately

2022 1099-MISC and 1096 Templates — 1099misctemplate.com

IRS Form 1099-C ≡ Fill Out Printable PDF Forms Online

2024 1099-MISC Form: Fillable, Printable, Download. 2024 Instructions

.png)

Can You Print 1099 Forms From a Regular Printer? Everything You Need to Know

1099-NEC Forms, Copy B for Recipient Federal - DiscountTaxForms.com

1099 NEC Editable PDF Fillable Template 2024 With Print and Clear Buttons Courier Font - Etsy

1099 NEC Editable PDF Fillable Template 2024 With Print and Clear Buttons Courier Font - Etsy

W-2 and 1099 Template

1099 Form Online | Make Instant Form 1099 FREE | PayStub Direct

2024 Form IRS 1096 Fill Online, Printable, Fillable, Blank - pdfFiller

Free Printable 1099 Template - It s free to use but you ll need to apply for an IRIS Transmitter Control Code TCC Some third party providers also facilitate Form 1099 NEC filings through their software The deadline for filing Form 1099 NEC with the IRS is January 31 2025 for the 2024 tax year You must also provide a copy to your recipient payees by this date