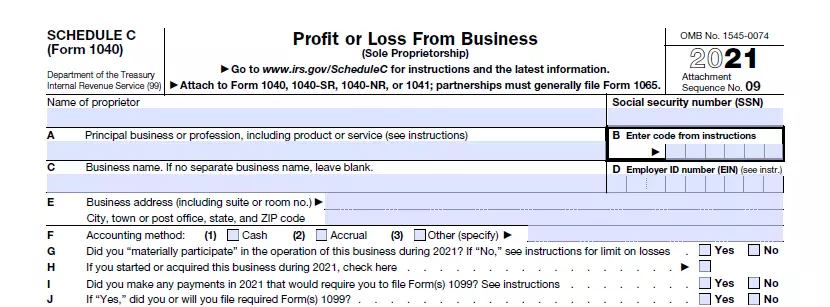

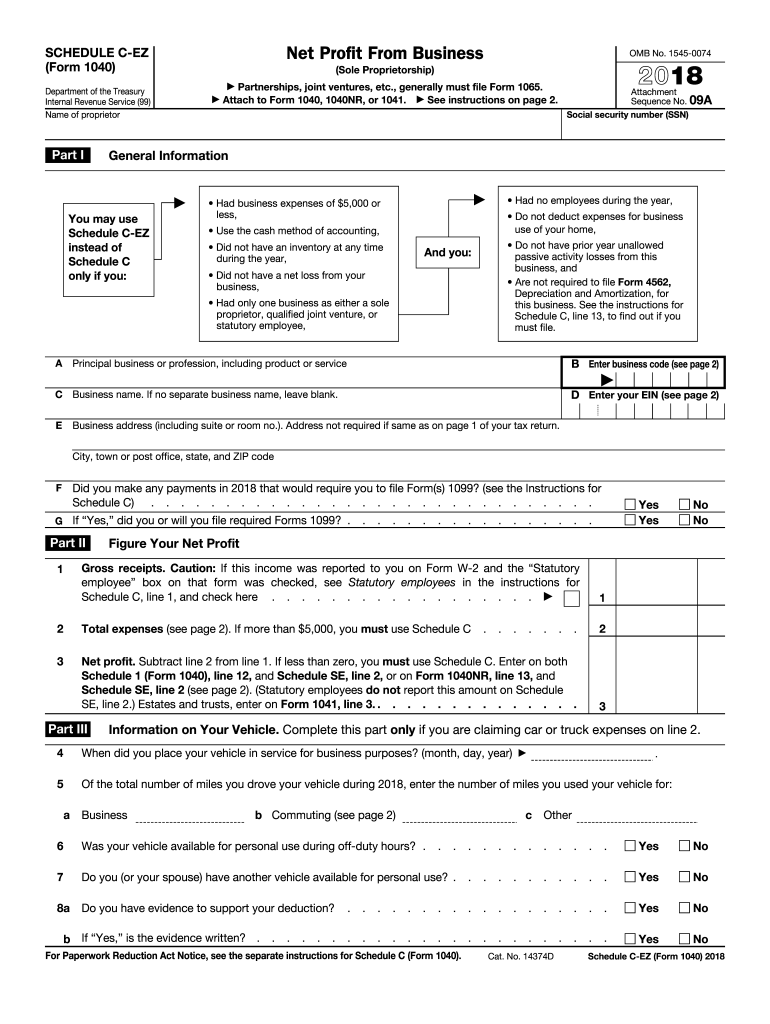

Free Printable Schedule C Tax Form Profit or Loss from Business Sole Proprietorship 2024 Schedule C Form 1040 SCHEDULE C Form 1040 Profit or Loss From Business Department of the Treasury Internal Revenue Service OMB No 1545 0074 2024 Sole Proprietorship Attach to Form 1040 1040 SR 1040 SS 1040 NR or 1041 partnerships must generally file Form 1065 Go to www irs gov

If you have 400 or more of business income over and above your expenses you need to file a Schedule C or C EZ and a Schedule SE to pay self employment tax even if you would not otherwise have enough income to be required to file a tax return pdf and you will need the free Acrobat Reader to view and print the files Schedule C Form File your Schedule C with the IRS for free Report self employment income and expenses E File schedules for form 1040 and form 1040 SR using FreeTaxUSA All Years 2017 2023 File 2023 Tax Return File 2022 Tax Return File 2021 Tax Return View My Prior Year Return s After You File

Free Printable Schedule C Tax Form

Free Printable Schedule C Tax Form

2018-2025 Form IRS 1040 - Schedule C-EZ Fill Online, Printable, Fillable, Blank - pdfFiller

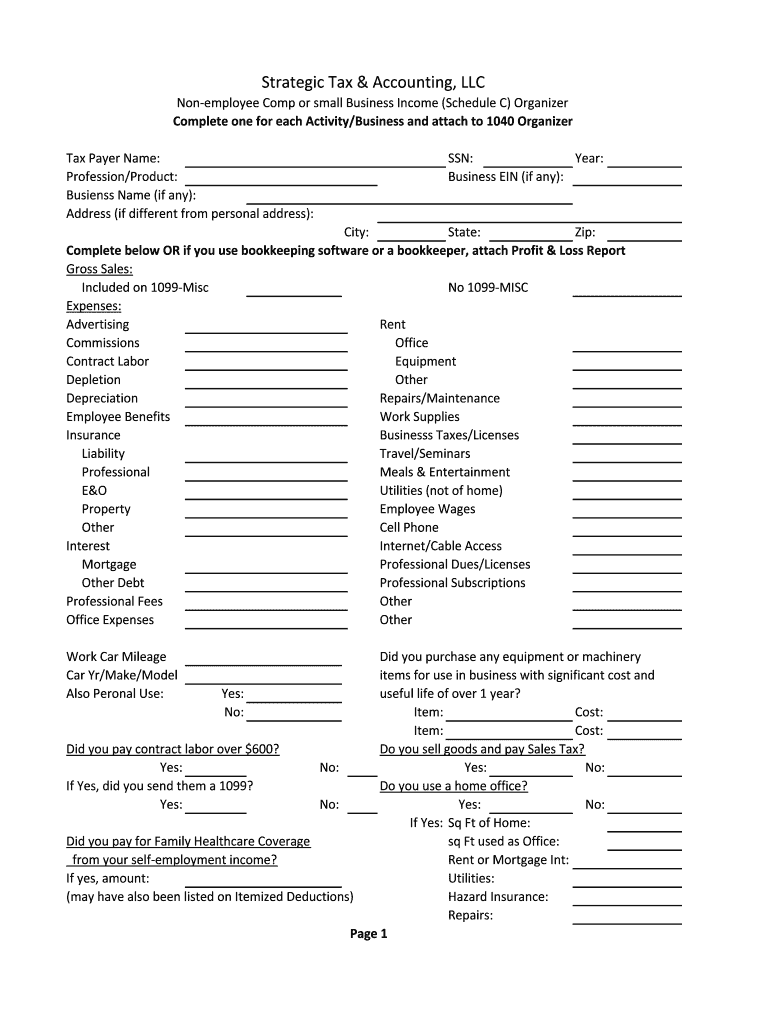

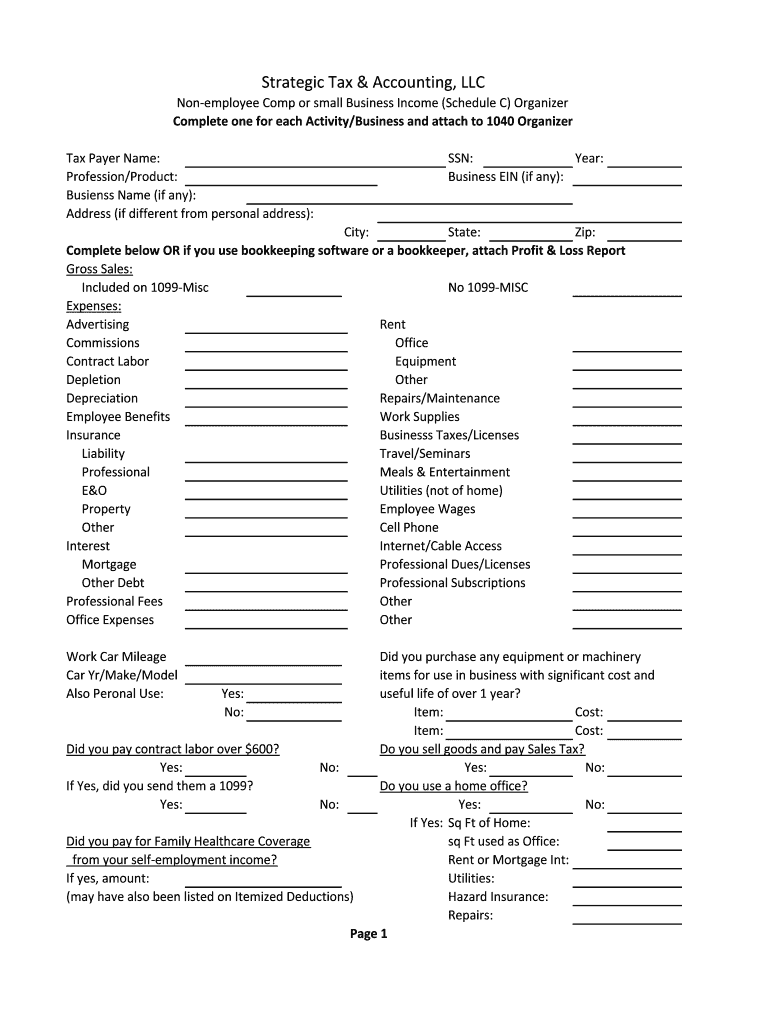

Schedule C Expenses Worksheet - Fill Online, Printable, Fillable, Blank | pdfFiller

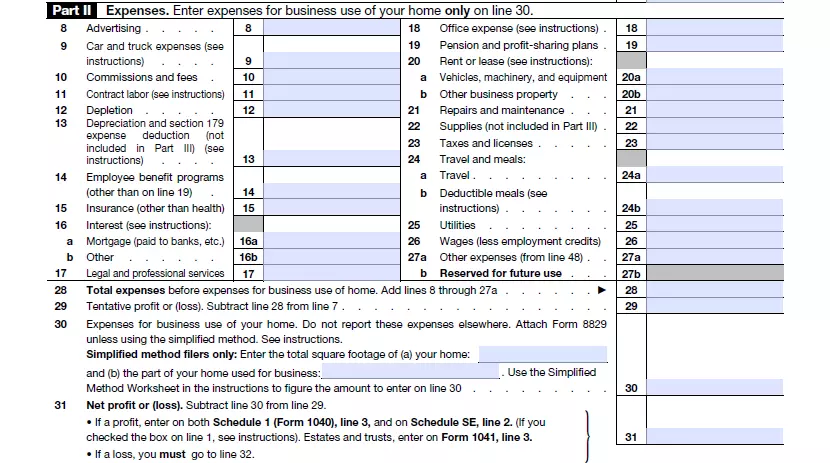

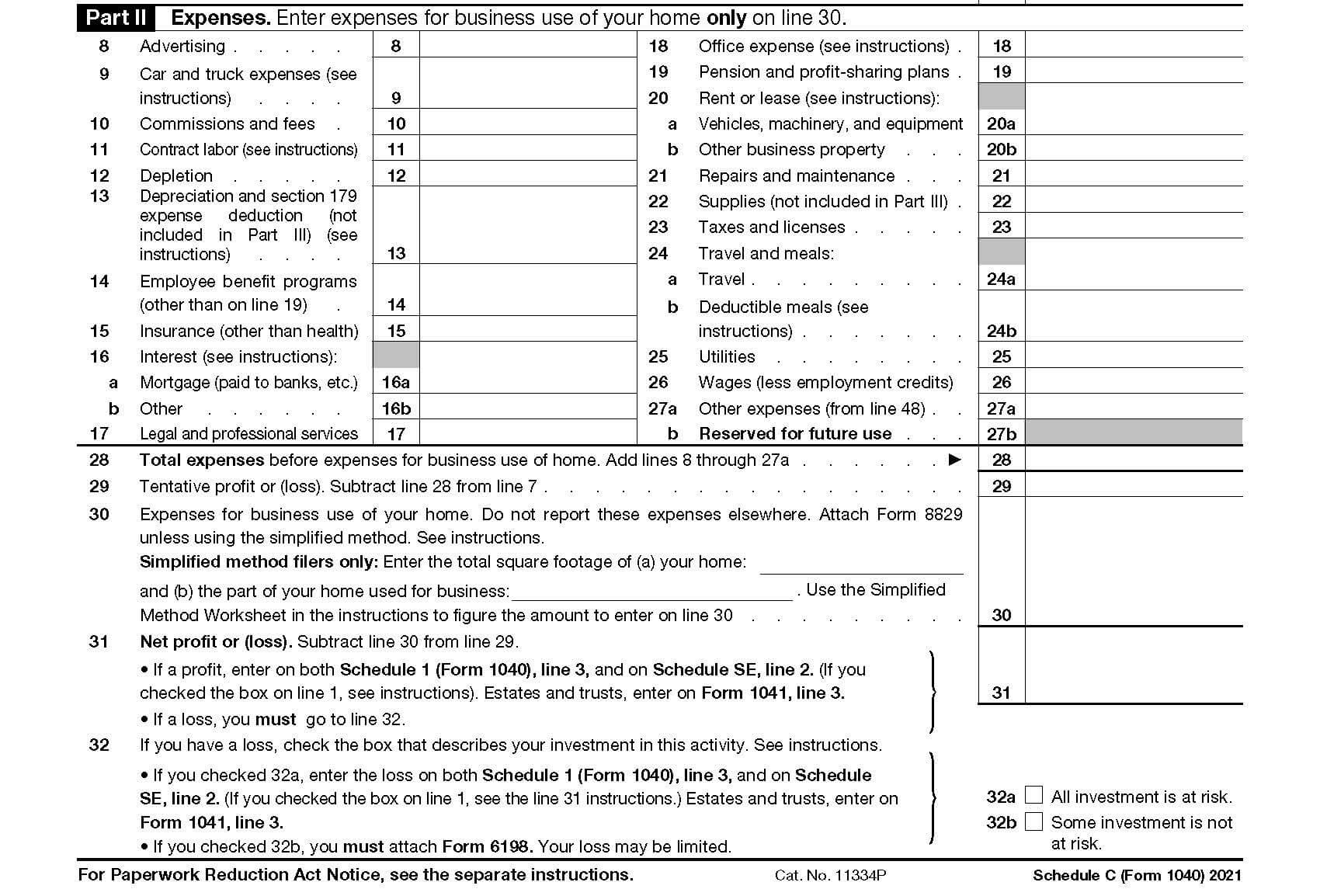

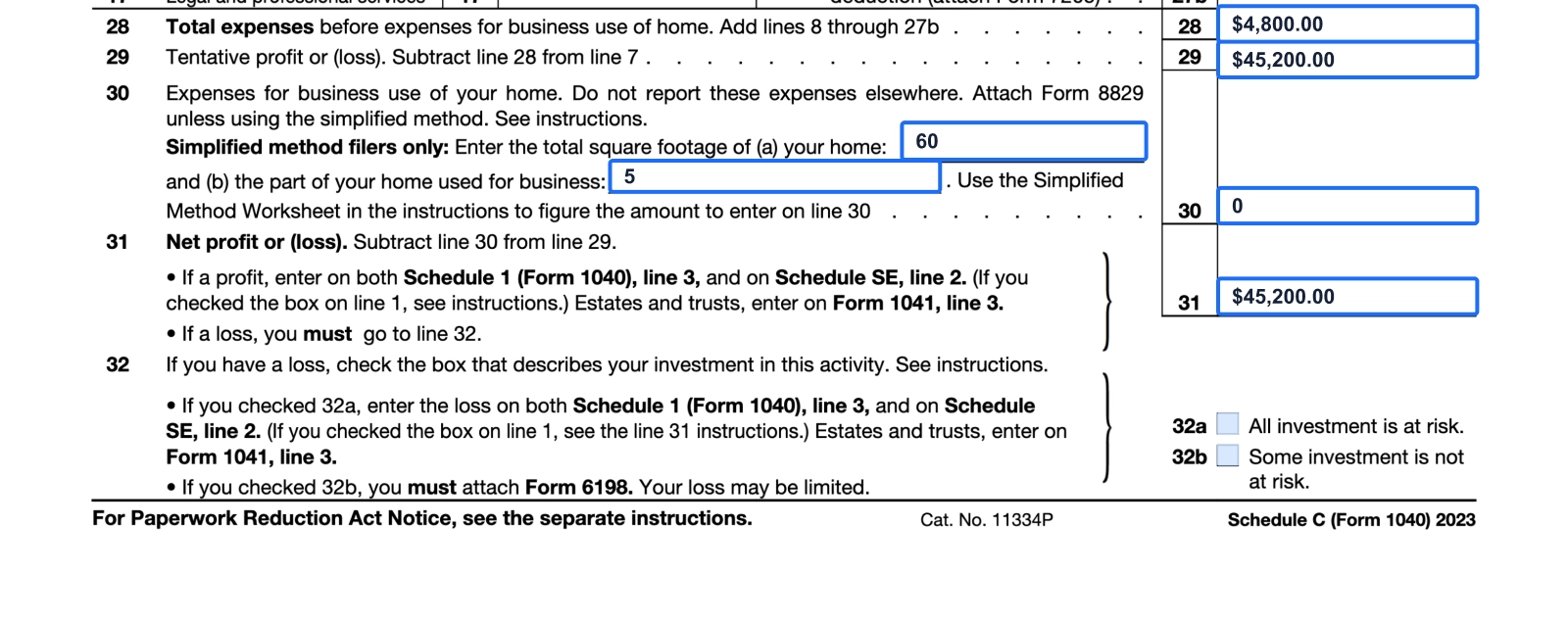

We last updated Federal 1040 Schedule C in January 2025 from the Federal Internal Revenue Service This form is for income earned in tax year 2024 with tax returns due in April 2025 We will update this page with a new version of the form for 2026 as soon as it is made available by the Federal government Other Federal Individual Income Tax The Best Way to reduce you taxable income is Track Income Expenses for Tax Form 1040 Schedule C I would love for you the taxpayer to get out your shoebox of receipts and let s get organized Our team at Taxko created this handy Schedule C Worksheet for your profit or loss record keeping pleasure If you re wondering how to fill out the Schedule C Form 1040 check out this quick video

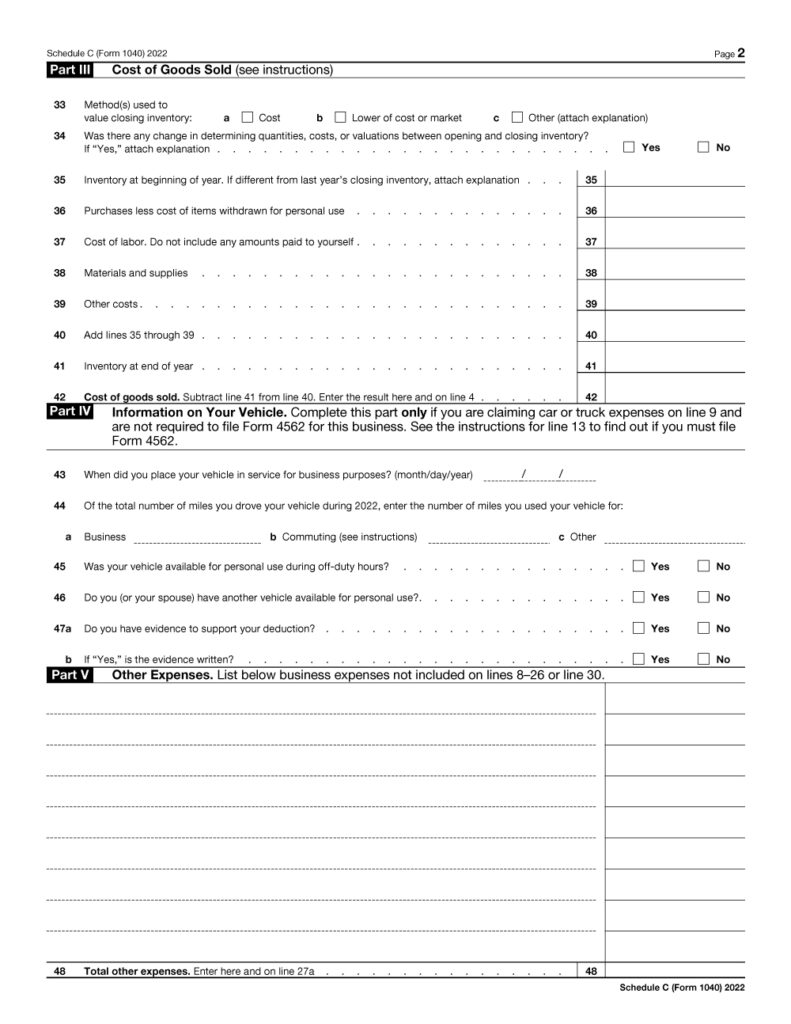

Sole proprietors get out your shoebox of 2022 receipts and let s get organized Our team at Blue Fox created this handy Schedule C Worksheet for your profit or loss record keeping pleasure If you re wondering how to fill out the Schedule C Form 1040 this easy to use tool will get your financial ducks in a row We highly recommend using it before you attempt the official IRS form How Form 1040 SS filers should report expenses for the business use of their home on Schedule C Form 1040 in 2023 04 JUNE 2024 Changes to the 2023 Instructions for Schedule C Form 1040 09 FEB 2024 Updated references for Publication 535 2023 Instructions for Schedule C Form 1040 23 JAN 2024

More picture related to Free Printable Schedule C Tax Form

Schedule C (Form 1040) 2023 Instructions

![Schedule C Instructions [with FAQs] schedule-c-instructions-with-faqs](https://www.thesmbguide.com/images/schedule-c-instructions-1266x960-20181218.png)

Schedule C Instructions [with FAQs]

What is an IRS Schedule C Form?

The 2023 Form 1040 Schedule C is a supplemental form used in conjunction with the Form 1040 to report the profit or loss from a sole proprietorship business This schedule is used by self employed individuals who operate a business as a sole proprietorship including freelancers independent contractors and small business owners Download Fillable Irs Form 1040 Schedule C In Pdf The Latest Version Applicable For 2024 Fill Out The Profit Or Loss From Business Online And Print It Out For Free Irs Form 1040 Schedule C Is Often Used In U s Department Of The Treasury U s Department Of The Treasury Internal Revenue Service United States Federal Legal Forms Legal And United States Legal Forms

[desc-10] [desc-11]

Fillable Online 2019 Schedule C (Form 1040 or 1040-SR) - Internal Revenue ... Fax Email Print - pdfFiller

1040 Schedule C Form ≡ Fill Out IRS Schedule C Tax Form 2021

https://www.taxformfinder.org/federal/1040-schedule-c

Profit or Loss from Business Sole Proprietorship 2024 Schedule C Form 1040 SCHEDULE C Form 1040 Profit or Loss From Business Department of the Treasury Internal Revenue Service OMB No 1545 0074 2024 Sole Proprietorship Attach to Form 1040 1040 SR 1040 SS 1040 NR or 1041 partnerships must generally file Form 1065 Go to www irs gov

https://www.wolterskluwer.com/en/solutions/bizfilings/tools-and-resources/tools-forms/schedule-c-form-1040-profit-or-loss-from-business-sole-proprietorship

If you have 400 or more of business income over and above your expenses you need to file a Schedule C or C EZ and a Schedule SE to pay self employment tax even if you would not otherwise have enough income to be required to file a tax return pdf and you will need the free Acrobat Reader to view and print the files Schedule C Form

How to Complete IRS Schedule C

Fillable Online 2019 Schedule C (Form 1040 or 1040-SR) - Internal Revenue ... Fax Email Print - pdfFiller

What is an IRS Schedule C Form?

How to Fill Out Your Schedule C Perfectly (With Examples!)

How to Fill Out Your Schedule C Perfectly (With Examples!)

Schedule C (Form 1040) 2023 Instructions

Schedule C (Form 1040) 2023 Instructions

2024 Schedule C-EZ Form and Instructions (Form 1040)

Taxes Schedule C Form 1040 (2023-2024) | PDFliner

Schedule C (Form 1040) 2023 Instructions

Free Printable Schedule C Tax Form - [desc-13]